XRP Price Prediction: Will It Reach $3 Amid Mixed Signals?

#XRP

- XRP is trading below its 20-day moving average but shows positive MACD momentum, indicating potential for upward movement.

- News sentiment is mixed with institutional adoption positives offset by retail demand concerns and capital outflows.

- The $3 target is achievable if technical support holds and regulatory developments like ETF approvals materialize.

XRP Price Prediction

Technical Analysis: XRP Trading Below Key Moving Average

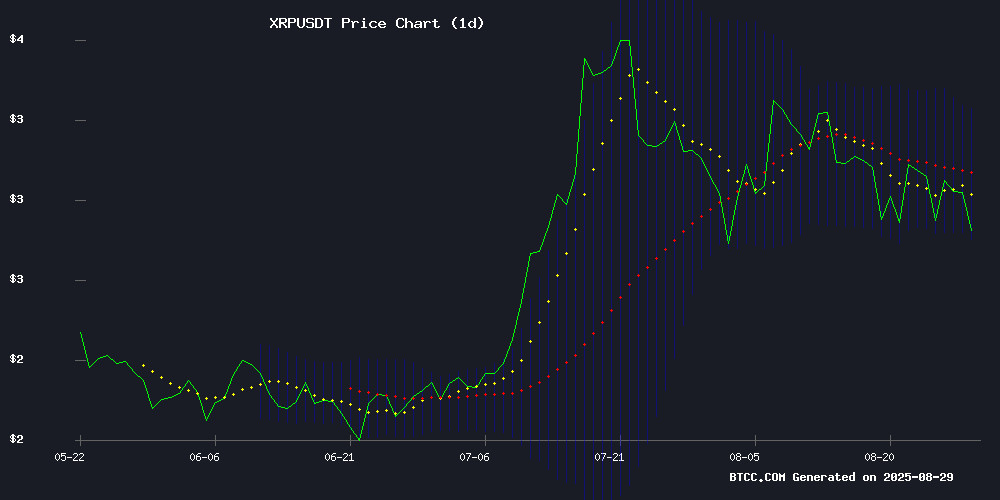

XRP is currently trading at $2.79, positioned below its 20-day moving average of $3.03, indicating short-term bearish pressure. The MACD shows a positive crossover with the signal line at 0.1023 and histogram at 0.0388, suggesting potential upward momentum. Bollinger Bands place the price NEAR the lower band at $2.78, which could act as support. According to BTCC financial analyst Emma, 'The technical setup shows mixed signals with the price struggling to break above the 20-day MA, but the MACD suggests underlying strength that could support a move toward $3 if buying pressure increases.'

Market Sentiment: Mixed News Flow Amid Institutional Developments

News sentiment presents a balanced picture with both positive institutional adoption and retail demand concerns. Ripple's Swell 2025 highlighting innovation and potential as a SWIFT successor contrasts with reports of waning retail interest and capital outflows. The anticipation of 15 XRP ETF approvals by the SEC provides regulatory optimism. BTCC financial analyst Emma notes, 'While institutional developments like Flare Network's adoption and mining solutions show growth, weak investor sentiment remains a headwind. The ETF approvals could be a significant catalyst for renewed momentum.'

Factors Influencing XRP's Price

Ripple Swell 2025 Set to Showcase Crypto Innovation and Institutional Adoption

Ripple Swell 2025, scheduled for November 4-5 in New York, is poised to deliver key insights into the evolving landscape of blockchain and cryptocurrency. The event will feature high-profile speakers including Ripple CEO Brad Garlinghouse, co-founder Chris Larsen, and executives from BlackRock, Fidelity, and Citi. Discussions will center on tokenization, payments, and regulatory advancements—areas where Ripple has been actively expanding its footprint.

The conference arrives as Ripple deepens its partnerships, notably with ONDO Finance to launch tokenized treasuries on the XRP Ledger. With XRP at the core of Ripple's payment solutions, the event may catalyze further institutional interest in the asset. Market participants anticipate bullish announcements that could reinforce XRP's role in bridging traditional finance and blockchain.

Ripple Price Forecast: XRP Faces Downward Pressure as Retail Demand Wanes

XRP extended its decline for a third consecutive day, with the cryptocurrency now testing critical support at $2.80. The bearish momentum follows a broader risk-off sentiment in crypto markets ahead of the Federal Reserve's September policy decision.

On-chain metrics reveal weakening fundamentals, with active addresses on the XRP Ledger collapsing to 24,000 from 50,000 in mid-July. Futures markets reflect the pessimism—open interest declined while liquidations accelerated amid the price drop.

Technical indicators suggest $2.50 could come into play if bulls fail to regain control. The remittance token's struggles mirror sector-wide pressures, with traders reducing exposure to altcoins amid macroeconomic uncertainty.

Flare Network Secures Second Corporate Client For XRP DeFi Treasury Framework

Flare Network has onboarded its second corporate client, Everything Blockchain, to utilize its XRP DeFi treasury framework. The MOVE enables the conversion of passive XRP holdings into yield-generating assets while maintaining regulatory compliance.

The framework addresses a longstanding challenge for institutional holders of XRP, which has lacked robust yield opportunities despite its $150 billion market capitalization. Flare's CEO Hugo Philion emphasized the institutional focus of the solution, noting its potential to transform XRP into a productive asset for corporations.

This development follows VivoPower International's $100 million XRP commitment to the platform, signaling growing institutional interest in XRP-based financial products. The back-to-back corporate adoptions suggest accelerating mainstream acceptance of digital asset treasury solutions.

Ripple's Strategic Expansion Positions It as Potential SWIFT Successor

Ripple's quiet yet aggressive expansion into global payment corridors is fueling speculation that it may emerge as the modern counterpart to SWIFT. The blockchain firm's recent investment in Singapore-based Tazapay—a licensed payment processor handling $10B in annual volume—signals a deliberate pivot toward regulated infrastructure for cross-border settlements.

Crypto analyst Stern Drew frames the move as a strategic backdoor into international trade, leveraging Tazapay's 300% YoY growth across 70 markets. Unlike many crypto-native payment projects, Ripple's focus on compliance-first partners like Tazapay demonstrates institutional-grade positioning.

The development underscores a broader industry trend: blockchain infrastructure providers are no longer challenging traditional finance from the periphery, but embedding themselves within its regulatory frameworks. Ripple's XRP-led solutions now appear less like disruptive experiments and more like viable alternatives to legacy systems.

XRP Price Targets $20: Analyst Outlines Key Scenarios for Rally

Crypto analyst XForce has set a $20 price target for XRP, citing two potential pathways for the altcoin's upward trajectory. The first scenario involves a strong impulse continuation, while the second hinges on a Wave 1-2 Flat pattern. Despite resistance NEAR $4, the macro outlook remains bullish.

Smart money accumulation signals confidence in XRP's long-term potential, even as retail investors hesitate. Short-term pullbacks are possible, but the analyst dismisses fears of a 60-70% downturn like previous cycles. Current price levels may FORM the foundation for the next major rally.

XRP Consolidates Above Bullish Flag, $6 Target in Sight

XRP has broken out of a bullish flag formation on weekly charts, now consolidating near the $3 mark. This pattern typically signals continuation, with analysts eyeing a potential rally toward $5–$6 if key support levels hold.

The token spent nearly three years in a symmetrical triangle before its late-2024 surge. Current price action shows the 9-period moving average above the 21-period—a bullish crossover—while the Accumulation/Distribution line hints at stabilizing selling pressure.

Short-term resistance sits at $3.10, with critical support near $2.83. A sustained drop below both moving averages could invalidate the setup, but for now, the structure favors buyers.

Everything Blockchain Inc. Adopts Flare’s XRP Yield-Bearing Structure

Everything Blockchain Inc., a digital asset treasury firm, has become the second publicly-traded company to integrate Flare’s XRP yield-bearing framework. The move signals growing institutional interest in leveraging XRP for decentralized finance (DeFi) applications.

Flare, a layer-1 network specializing in DeFi interoperability, designed the XRPFi structure to enable compliant yield generation for XRP holders. The framework allows institutions to deploy XRP productively—a first for the $150 billion asset, which has historically lacked yield-bearing opportunities.

The adoption follows VivoPower International’s recent $100 million XRP commitment to Flare’s ecosystem. By embedding smart contract functionality, Flare transforms traditionally non-yielding assets into productive treasury tools, positioning XRP as a potential standard for corporate yield strategies.

XRP Price Struggles Amid Weak Investor Sentiment and Capital Outflows

XRP continues to face downward pressure as investor support wanes, with the altcoin failing to breach critical resistance levels. The lack of momentum from both existing holders and new participants has exacerbated the stagnation, leaving the asset vulnerable to further declines.

Network data reveals a concerning trend: new address growth has slowed to near two-month lows, signaling diminished interest from fresh investors. This contraction in demand has created a void, with insufficient buying pressure to counteract the selling activity. The Chaikin Money FLOW (CMF) metric underscores the bearish outlook, hitting a nine-month low as capital outflows dominate.

Without a resurgence in investor participation or a shift in macro sentiment, XRP's price action remains constrained. The shrinking capital pool and absence of sustainable support levels suggest continued challenges ahead for the embattled cryptocurrency.

APT Miner Launches XRP Cloud Mining App Amid Crypto's Green Energy Shift

The cryptocurrency mining sector is undergoing a quiet revolution as operators increasingly adopt renewable energy solutions. Solar and wind power are replacing traditional energy-intensive methods, slashing operational costs while allowing excess capacity to contribute to grid stability. This dual benefit of profitability and sustainability is reshaping investment strategies across the industry.

APT Miner's new cloud mining application targets XRP investors seeking passive participation without hardware complexities. The platform handles all technical operations - from equipment maintenance to energy optimization - while users simply select computing power contracts. Daily profit distributions occur automatically, eliminating the need for technical expertise or constant market monitoring.

Market volatility and rising technical barriers are driving retail investors toward cloud-based solutions. The model represents a fundamental shift from direct hardware ownership to managed service participation, particularly appealing for assets like XRP where mining accessibility remains limited compared to proof-of-work cryptocurrencies.

Siton Mining Introduces XRP-Based Mining Solution Amid Market Volatility

Siton Mining, a global cloud mining platform, has unveiled a new solution tailored for XRP holders seeking stability in turbulent markets. The offering combines hash power contracts with a risk-hedging mechanism, allowing users to convert XRP into mining contracts across flexible durations.

XRP's utility as a high-speed settlement token makes it particularly vulnerable to price swings. The platform's dynamic computing power allocation aims to insulate investors from volatility while generating yield. Contracts are available in short, medium, and long-term durations, providing liquidity options absent in traditional staking models.

The move comes as cryptocurrency markets face heightened uncertainty. "This bridges the gap between transactional utility and wealth preservation," observed one industry analyst, noting XRP's unique position in cross-border payments. Mining rewards are structured to compensate for token depreciation during market downturns.

15 XRP ETFs Await SEC Approval as Regulatory Winds Shift

The cryptocurrency landscape braces for potential transformation as 15 XRP ETF applications sit before the SEC. This regulatory pivot follows the TRUMP administration's softened stance toward digital assets—a stark contrast to the Biden era's restrictive approach. Market observers now watch for approvals that could funnel institutional capital into Ripple's native token.

Bloomberg reports confirm the pending applications, with deadlines looming in October. Analyst Kenny Nguyen notes the filings are part of a broader wave—over 90 crypto ETFs currently under SEC review. XRP's price trajectory appears tethered to these decisions, as ETF approvals historically catalyze significant capital inflows.

The development has ignited speculation across crypto circles. While some analysts predict a double-digit rally for XRP, others caution that regulatory hurdles remain. The coming months will test whether the SEC's evolving posture translates into actionable market opportunities.

Will XRP Price Hit 3?

Based on current technical and fundamental analysis, XRP faces resistance near the $3 level but has potential catalysts that could drive it higher. The price at $2.79 is below the 20-day MA of $3.03, which acts as immediate resistance. However, positive MACD momentum and potential ETF approvals could provide the boost needed. BTCC financial analyst Emma states, 'Reaching $3 is plausible if XRP maintains support at the Bollinger lower band and benefits from positive regulatory developments. However, weak retail demand may delay this move until institutional inflows strengthen.'

| Metric | Value | Implication |

|---|---|---|

| Current Price | $2.79 | Below resistance |

| 20-Day MA | $3.03 | Key resistance level |

| Bollinger Lower | $2.78 | Near-term support |

| MACD Histogram | 0.0388 | Positive momentum |